|

|

|

|

|

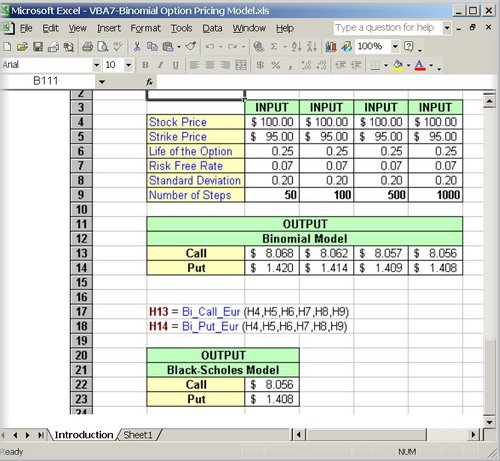

In this example, we derived call and put option price using the binomial model, also known as the Cox-Ross-Rubinstein option model. Note that binomial distribution will become normal when the number of steps (n) becomes large. Hence, when n increases, both of the call and put option prices estimated from the binomial model come close to the prices estimated from the Black-Scholes model.

See Examples below;

Standard Deviation and Mean

>

Lotto Number Generator

>

Playing Card

Probability

>

Normal Distribution Random Number Generator

>

Monte Carlo Integration

>

Black-Scholes Option Pricing Model - European Call and Put

>

Binomial Option

Pricing Model

>

Portfolio Optimization

>

Multiple Regression

>

Bootstrap - A

Non-Parametric Approach

>

Multivariate Standard Normal Probability Distribution

>

Monte Carlo Simulation

>

Option Greeks Based on Black-Scholes Option Pricing Model.

Special! Free Choice of

Complete Excel Training Course

or Excel Add-ins Collection

on all purchases totaling over $59.00.

ALL purchases totaling over $150.00 gets you BOTH! Purchases MUST be made via this site. Send payment proof to [email protected] 31 days after purchase date.

Instant Download and Money Back Guarantee on Most Software

Excel Trader Package Technical Analysis in Excel With $139.00 of FREE software!

Microsoft � and Microsoft Excel � are registered trademarks of Microsoft Corporation. OzGrid is in no way associated with Microsoft